Why NFT Auctions on TON Outshine OpenSea

In the fast-evolving world of digital assets, understanding why auctions on the The Open Network (TON) pave a smoother, more efficient path than traditional platforms like OpenSea is critical — especially for creators, collectors and project-builders who seek speed, low cost and community alignment.

Anchors by category

- What is TON & how its NFT auctions work

- Core advantages of TON-based auctions

- How OpenSea works (and its constraints)

- Why TON auctions offer greater convenience than OpenSea

- Practical considerations & caveats

- How I support crypto projects & NFT launches

What is TON & How Its NFT Auctions Work

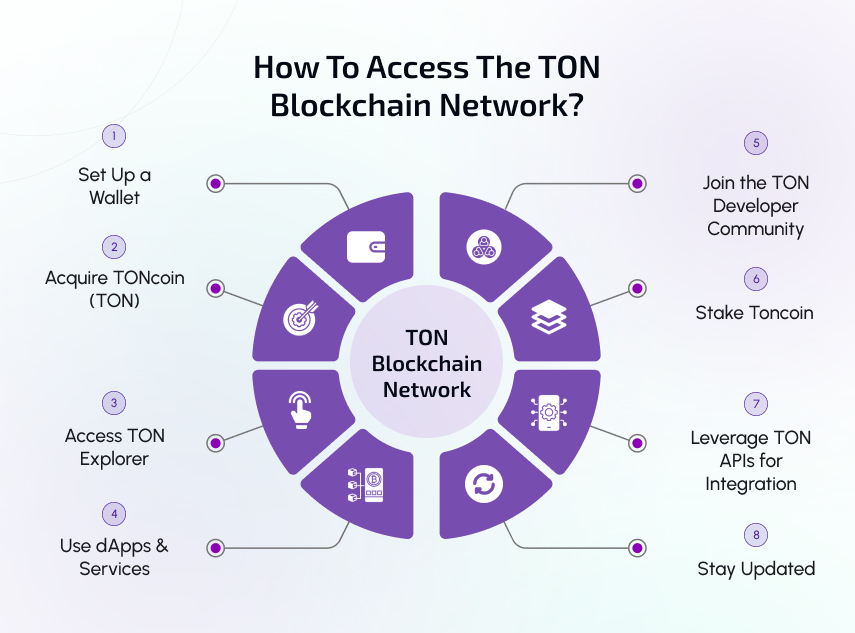

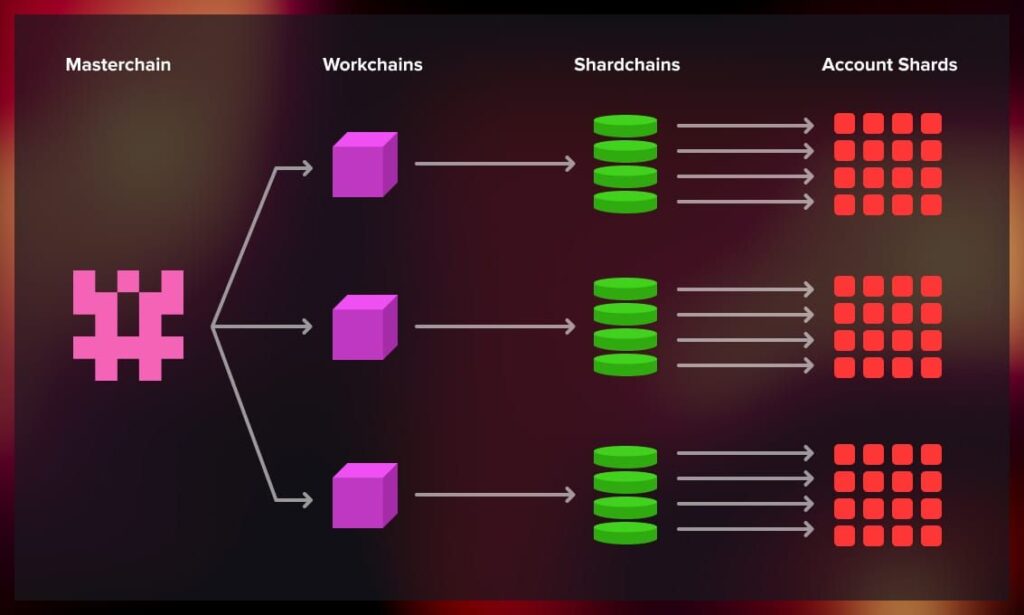

The Open Network (TON) is a high-performance blockchain originally developed by the team behind Telegram. It supports an “NFT 2.0” standard, which explicitly includes auction mechanisms, offers, and royalty enforcement.

On TON, marketplaces such as GetGems and TON Diamonds allow users to list NFTs via bidding auctions, set reserve prices, and tap into the Telegram-integrated wallet ecosystem.

Because TON’s architecture emphasises low fees and fast transaction confirmation, auctions can run with minimal friction.

Core Advantages of TON-Based Auctions

1. Lower transaction and listing costs

TON’s network design means that minting, listing and transferring NFTs typically involve far lower fees compared to legacy chains like Ethereum. This translates into cost-savings for creators and collectors. For TON marketplaces, this is a highlighted benefit.

2. Native support for auctions & flexible bidding

The TON NFT-2.0 standard specifically outlines support for auctions and offers, meaning the technical underpinning is built with bidding functionality in mind — not merely a workaround.

3. Efficient workflow and Telegram integration

Because TON is tightly integrated with Telegram (wallets, bots, authentication), managing NFTs and participating in auctions becomes more user-friendly. For many users this feels closer to “click and bid” rather than heavy-crypto onboarding.

4. Faster settlement & less congestion

As TON was built for throughput, auctions settle faster and are less likely to suffer from congestion or high gas delays — meaning bid execution and finalisation are smoother.

5. Emerging ecosystem advantage

While still growing, TON’s NFT ecosystem offers unique asset types: Telegram-usernames, anonymised numbers, domain-style assets tied to Telegram identity. These are less common on OpenSea and give TON a niche advantage.

How OpenSea Works (and Its Constraints)

OpenSea remains the dominant NFT marketplace globally, built originally on Ethereum and later supporting a wide array of chains.

OpenSea supports both fixed-price listings and auctions, with features like timed auctions, ‘reserve price’ options, bundles, etc.

However, because of its multi-chain model, legacy architecture, and large volume of users, some constraints persist: higher fees, slower blockchain settlement (especially on Ethereum), variable user-experience, and occasionally clunky bidding flows.

Moreover, fixed-price versus bidding dynamics: research shows auctions may capture better value for unique assets.

Why TON Auctions Offer Greater Convenience Than OpenSea

Putting the pieces together, here is why auctions on TON can be considered more convenient than on OpenSea:

- Reduced friction in bidding workflow: On TON, auctions are native, low-fee, and often integrated with familiar platforms (Telegram). On OpenSea you may deal with multiple chains, higher gas, wallet setup complexity.

- Lower cost barrier: For creators listing their assets, TON’s lower costs mean fewer upfront hurdles; collectors bear lower transaction costs. This is a vital convenience.

- Faster time-to-finalise: Auction end-to-finalisation is quicker on TON; for high-velocity markets or frequent drops this matters.

- Niche asset types & tighter community: With identity NFTs (usernames, numbers) and specialised collectibles, TON auctions cater to certain use cases more directly than generalist OpenSea flows.

- Clear royalty/offer mechanisms baked-in: TON’s NFT-2.0 spec ensures royalties, offers and auctions are supported at protocol level.

- Streamlined creation/listing experience: Because TON marketplaces emphasise usability (via Telegram bots, simpler onboarding), creators can launch auctions faster and with less technical overhead.

- Less competition noise in auction space: On OpenSea auctions compete with fixed-price listings across many chains; on TON they may benefit from more auction-centric flows and less clutter.

Practical Considerations & Caveats

Of course, convenience does not mean “perfect for all”. Some aspects to keep in mind:

- Smaller ecosystem / liquidity: TON’s NFT marketplace volume is still smaller than OpenSea’s massive ecosystem; so “exposure” may be less.

- Asset-type suitability: If your asset is targeting a broad global crypto audience via major Ethereum-based collectors, OpenSea still has reach. TON may suit identity-NFTs, Telegram-linked assets, etc.

- User-familiarity: Many users and collectors are already on OpenSea; moving them to TON may require onboarding and education.

- Protocol risk / newer infrastructure: While TON is robust, newer models bring innovation and also risk; always ensure contract audits, marketplace reliability.

- Secondary market dynamics: Auction success depends on bidder pool; smaller pool means smaller competition, which could reduce upside. One must consider volume and marketing.

- Interoperability / cross-chain versatility: OpenSea supports many chains, making it versatile for users holding assets across ecosystems. TON is more focused.

How I Support Crypto Projects & NFT Launches

As an expert in promoting businesses and crypto projects on the internet, my service covers comprehensive support:

- Designing full social-media campaigns and community growth strategies.

- Forming and managing a dedicated team for your project: from community managers, creatives, marketers to technical support.

- Monitoring implementation of tasks to ensure delivery, KPIs, and adaptively iterating strategy.

- Training in-house staff in managing social networks effectively (Telegram, Twitter/X, Discord, Instagram, etc.) so they can drive sales and project momentum independently.

Created an amazing NFT collection - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide) — Pi is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get Pi, follow this link. https://minepi.com/Tsybko and use my username (Tsybko) as an invitation code.

Bybit: Use this link, (All possible commission discounts and bonuses up to $30,030 included) If you register through the app, then at the time of registration, simply enter in the ref field: WB8XZ4 - (Management)

Bitget - Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Binance Free $100: Use this link, To sign up and get $100 free and a 10% discount on Binance Futures fees for the first few months (Terms and Conditions).

Tags:

Article on the topic:

Бинанс: Как Заработать

Бинанс: Как Заработать Заработок на стейкинге Без Риска 25% годовых .

Заработок на стейкинге Без Риска 25% годовых . Можно ли Заработать на Криптовалюте?

Можно ли Заработать на Криптовалюте? Заработок Криптовалюты

Заработок Криптовалюты